Council tax bills are set to increase for almost all homes in England, with most councils imposing maximum rises.

70% of England’s people will see this yearly rise. Only nine councils are boosting bills less than 4.5%. The 4.99% cap includes care costs at 2%. This cap has existed for three years now. A study shows 68% raised taxes the max each year. 84% did that in the last two years as well.

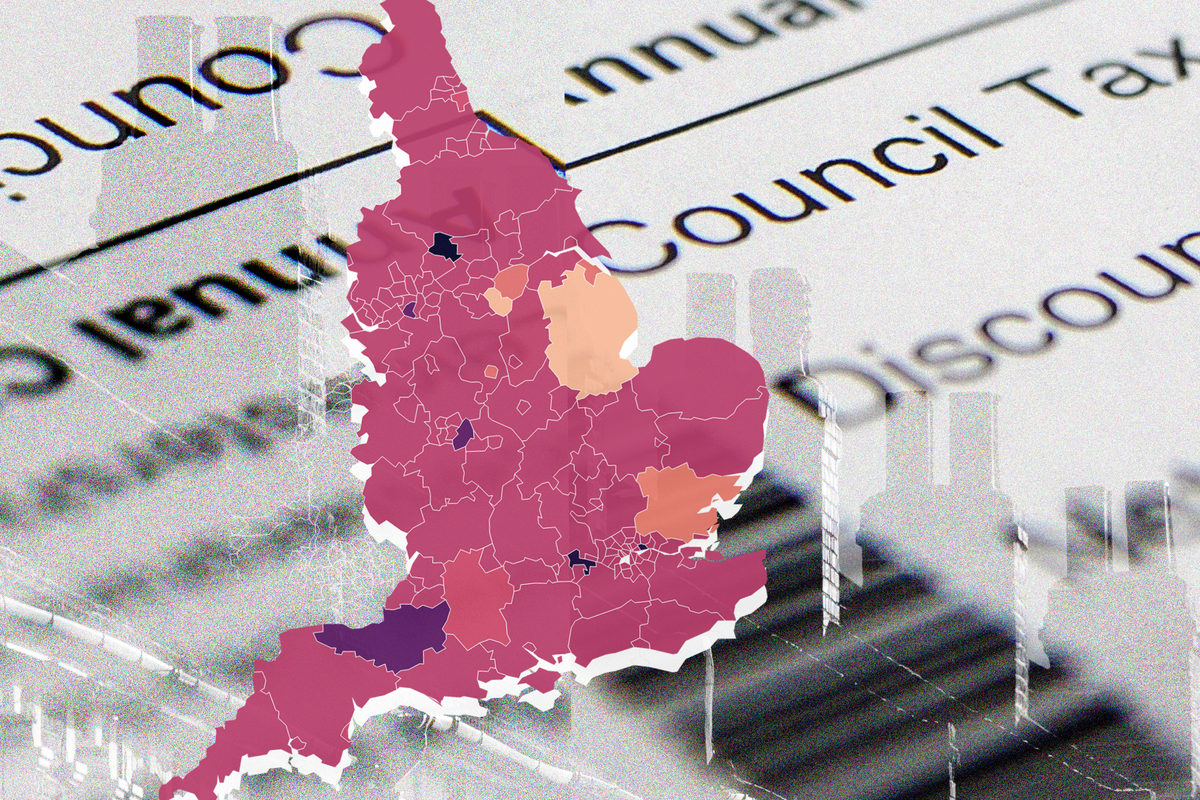

In the North West, almost all are raising taxes to the limit. Only Warrington and Trafford buck this trend. Trafford got permission to raise taxes 7.49%. Just three London councils will raise taxes less than 4.99%. These are Wandsworth, Kensington & Chelsea, and Barnet.

Newham got permission for an 8.99% increase. All 20 South East councils approved a 4.99% rise or higher. Windsor & Maidenhead are raising taxes 8.99%. Several other councils are not hitting the limit. Essex is the only East of England council not at the cap.

Nottinghamshire, Derby, and Lincolnshire are also below it. Coventry raised taxes 4.9%. It is the only West Midlands council not at the limit. Birmingham can raise taxes higher, to 7.49%. Bradford also got permission for a large rise. It will increase taxes 9.99%.

Maximum tax rises affect rich and poor areas alike. All twenty poorest council areas will raise taxes fully. Local finances are struggling, and the government is helping. They gave money to 30 councils recently. Some councils also received aid in past years.

Wandsworth Council has the lowest increase at 2%. Lincolnshire’s is 2.99% and Rotherham’s is 3%. Essex will raise taxes 3.75%. North East Lincolnshire is at 3.98%. Doncaster and Derby are both at 3.99%. Kensington & Chelsea are raising taxes 4%. Sunderland will increase taxes by 4.49%.

The government says councils decide tax levels. But, they should consider what this means for people. Referendums protect taxpayers from huge increases. Taxpayers get the final say.